How to Complete W-8BEN-E form for Your SMSF

To trade U.S. investments or receive investment income from the U.S., non-U.S. residents—including Australian SMSFs—must complete the W-8BEN-E Form. iCare Super offers comprehensive administration, taxation, and compliance services for U.S. investments without any additional costs or restrictions.

The only sections that needs be completed on this form for your SMSF are Part I, Part III, Part XII and Part XXX.

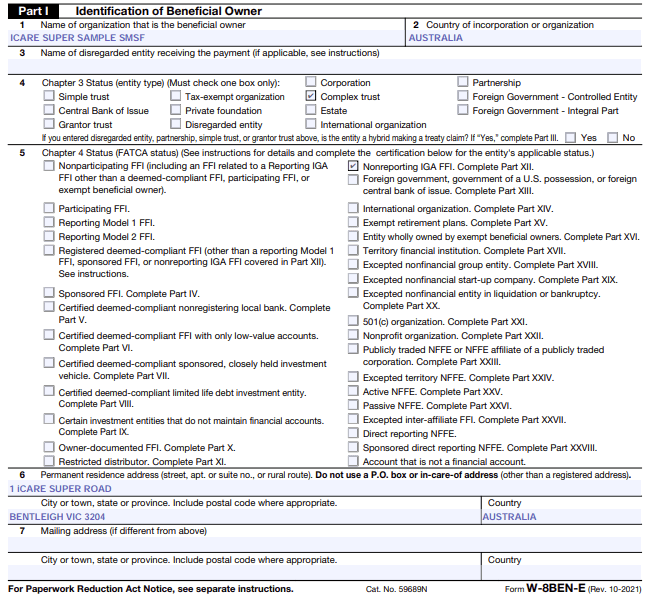

Part I – Identification of Beneficial Owner

- Item 1. fill in full name of the SMSF exactly as it appears on the SMSF Trust Deed.

- Item 2. Write “Australia”.

- Item 3. Leave blank.

- Item 4. Tick “Complex trust”.

- Item 5. Tick “Nonreporting IGA FFI”.

- Item 6. Provide the SMSF’s principal place of business, or registered office address. Do not provide a PO Box or care-of address.

- Item 7. Leave blank.

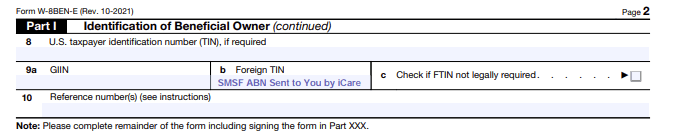

- Item 8. Leave blank.

- Item 9a. Leave blank.

- Item 9b. Enter the SMSF’s ABN.

- Item 10. Leave blank.

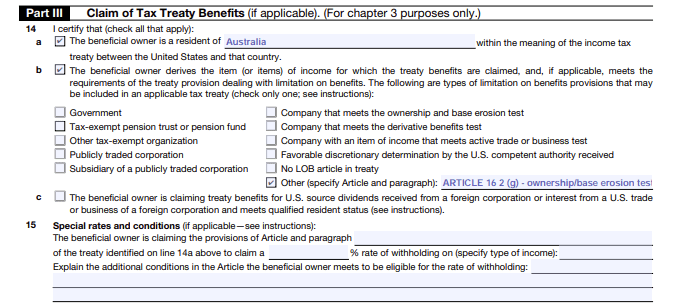

Part III – Claim of Tax Treaty Benefits (if applicable). (For Chapter 3 Purpose only.)

- Item 14a. Tick box and write “Australia” in the space provided. ( The beneficial owner is a resident of AUSTRALIA within the meaning of the income tax treaty between the Unites States and that country.)

- Item 14b. Tick 2 boxes. 1) Tick the first box “The beneficial owner derives the item (or items) of income for…”. 2) Tick the last box: Other (specify Article and paragraph) and write ARTICLE 16 2 (g) – ownership/base erosion test.

- Item 14c. Leave blank.

- Item 15. Leave blank.

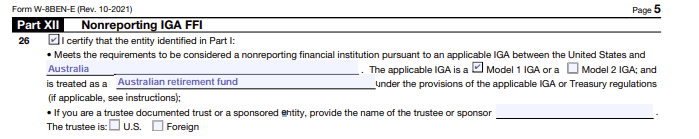

Part XII – Nonreporting IGA FFI

- Item 26. Tick the first box. Write “Australia”, tick box for Model 1 IGA and write “Australian retirement fund” in the space after it says “is treated as a …”

- Leave blank for the rest.

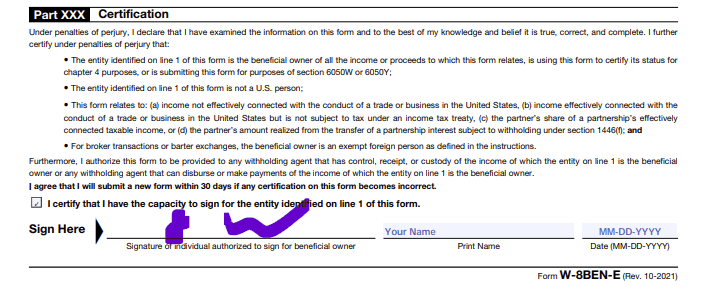

Part XXX: Certification

Only one individual trustee or one director of a corporate trustee should print their name and sign and write the date of signing the form.

Please make sure you use the US date format: MM/DD/YYYY

After completing the W-8BEN-E form, you can submit it to your trading platform or broker. The form remains valid for three years from the signing date.

U.S. investments in your SMSF are allowable assets for administration by us, including U.S. stock market investments and properties. We impose no restrictions on the type or volume of transfers and charge a fixed fee for annual returns, reporting, and audits. For details, please refer to our fee schedule. Contact us if you have any questions regarding this.