Property Operation

Property operation:

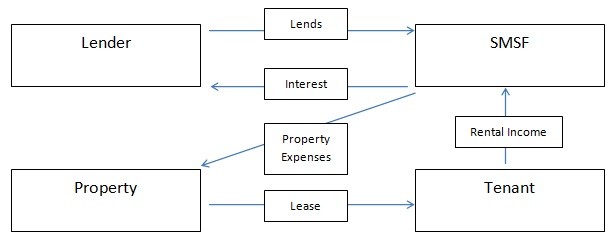

The borrowing structure will operate as follows on an ongoing basis:

- Interest and principal paid to the lendersThe interest will be paid from the bank account of the SMSF. The trustee of SMSF can use the rental income of the property and any other income (or contributions from member(s)) of the fund to pay interest and principal amount of the loan to the external lender. The trustees of the fund need to ensure there are sufficient funds in the bank account to meet the repayments to the lenders.

- Rental Income of property:Once title of the property is transferred to the trustee of the custodian/bare trust, it can be rented to any unrelated parties.The rental income will be paid the bank account of the SMSF and treated as income received in the fund.Please note residential property cannot be rented to any related party (part 8 associates).However, a business real property can be rented to a related party and do not breach the in-house asset rules. However, there should be a legal lease document in place if the tenant is a related entity (business entity of the member).The lease document needs to ensure the related party pays market rent to the SMSF.

- Rental Expenses:

All the rental expenses should be paid from the bank account of the SMSF and treated as expenses deductions in the fund. It can be paid by the members from their personal bank account and treated as member contributions. - Options when the mortgage is paid off:Once the mortgage is paid of f by the trustee of the SMSF, the trustee of SMSF has two choices:

A. Sell the property to any unrelated party

B. Transfer the property into the SMSF. So the legal owner of the property will be the trustee of the SMSF. There is no stamp duty to be paid as the real owner is always the trustee of the SMSF.