Property Purchase

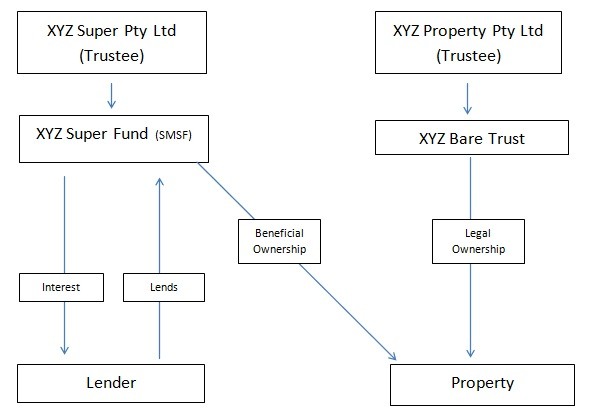

Property Purchase Structure Requirement for the SMSF:

An SMSF with a corporate trustee and a bare trust with a separate corporate trustee is the most common and recommended structure for purchasing property within an SMSF. We can establish both structures within 1-2 days and provide detailed guidance throughout the entire property purchase process.

A typical Structure of the SMSF borrowing:

Step-by-step for Property Purchase within an SMSF:

To ensure compliance with the borrowing rules, the trustees of an SMSF should follow these steps for purchasing property:

1. Review Trust Deed and Investment Strategy: Ensure the SMSF’s trust deed and investment strategy permit borrowing and property investment. iCare Super will update these documents as needed.

2. Find the Property: Identify a suitable property for the SMSF and send the address and details, along with the unsigned contract of sale, to admin@icaresuper.com.au.

3. Assess Your SMSF’s Borrowing Capacity:

Consult with lenders or iCare Super to assess your SMSF’s borrowing capacity. Choose from over 10 SMSF lenders on the market, most of which offer an 80% Loan-to-Value Ratio (LVR) and may require personal guarantees.

4. Pay Deposit: The SMSF trustee will typically need to pay a 10% deposit to the vendor. Ensure the receipt names the SMSF trustee as the purchaser.

5. Establish Corporate Trustee for Custodian/Bare Trust: Set up a new company as the corporate trustee for the custodian/bare trust, which must be separate from the SMSF trustee. This company will only hold the asset in trust and incur standard Annual ASIC Review Fees.

6. Set Up Custodian/Bare Trust: Establish the custodian/bare trust with a trust deed, including the property address. Ensure the deed is stamped by the State Revenue Office before property transfer. Check state-specific stamp duty requirements.

7. Purchase the Property: The purchase contract must list the “trustee of the bare trust ATF bare trust” as the buyer. Verify that this name appears on transfer records.

8. Obtain Final Loan Approval: Receive and sign the final loan approval documents from the lender.

9. Property Settlement: At settlement, the lender will pay the loan amount to the vendor. The SMSF will cover the balance and additional costs, such as stamp duty and legal fees, via bank cheques as directed.

If you have any questions about borrowing to purchase property, please feel free to contact us.

Please note that the above information is for general advice only. Consult with us for specific details tailored to your situation.